By Vandana Chatlani | Asia Business Law Journal

How much are you willing to pay for a lawyer’s time? For some corporate counsel, spending a large amount is justified if a law firm delivers prompt, precise and comprehensive advice. “We believe price consideration should in no way defeat the quality of the work we look for when we instruct a law firm,” says an in-house counsel with a top state-owned insurance company in China.

Corporate counsel have also started to claw back much of the work they once outsourced, turning to private law practitioners only when absolutely necessary. Many have mastered the art of running a tight ship to manage their legal spending – training lawyers in-house, relying on technology, standardizing templates and documents, and sharpening their negotiation skills if money is to be spent on hiring external lawyers.

This focus on controlling legal budgets has translated into fee pressure and increasing rivalry among domestic and international law firms. Across Asia, firms are looking for new revenue models and ways to stay profitable by offering competitive rates, strengthening practice areas, hiring new talent and opening new offices.

Zhang Zhi, co-founder of V&T Law Firm in Beijing, says the legal services market in China has become “a buyer’s market” due to a substantial rise in the number of legal practitioners and “fierce competition between law firms”.

Jacqueline Zhao, a marketing manager at Merits & Tree in Beijing, agrees with this assessment, saying China’s legal services market “is becoming increasingly price-sensitive, and most firms have definitely been impacted”. She adds: “Price competition exists all the time and is much more severe than before.”

Sesto Vecchi, the managing partner at Russin & Vecchi, observes “greater fee comparison among law firms” in Vietnam.

In South Korea, many clients are sensitive to legal fees, says Steven Li, a foreign counsel at Orne Haneul in Seoul, and will engage whichever firm provides the lowest fee quote. “A few clients even tell us the rates that they have received from other firms and ask us if we can propose a lower fee,” he says.

The landscape in India is similar. “Firms in India tend to pitch aggressively to get work from corporates,” says Ganapathy CB, executive vice president for corporate affairs and group general counsel at Himatsingka Seide in Bengaluru, India. “We have seen law firms cutting down pricing to almost half of their initial quote when informed about a competitor’s pricing. This is not a bad trend and corporates tend to benefit from the competition.”

But competition between law firms and their charge rates isn’t the only factor driving legal costs down. In Australia, for example, fee structures have been affected by “different methodologies for the provision of legal services”, according to Gregory Ross, a partner at Eakin McCaffrey Cox in Sydney. These include the use of artificial intelligence (AI) in legal work, online legal documentation and advice, the increasing participation of non-lawyers doing legal work, and the multi-jurisdictional provision of legal services, “all of which change the matrix in various ways with a consequent impact on fees”.

The death of hourly billing?

Corporate counsel have learned that loosening their purse strings isn’t always necessary to get the best legal advice, particularly since many are now relying on their internal resources, reining in some of the work that would usually find its way to a law firm. This reduction in work outflow, a distaste for hourly billing and strong bargaining power have contributed to a move away from paying by the hour.

“Hourly billing, especially in the Indian context, isn’t a desired situation; rather it should be assignment or event-based,” says Gopinath AT, director of corporate finance, Embassy Property Developments in Bengaluru.

“Clients and lawyers often have differences on what work should be charged and the total number of a lawyer’s work hours, which has created many conflicts between clients and law firms,” says Yong Zheng, executive director at China Guangfa Bank.

Roderick Salazar III, a senior partner at Fortun Narvasa & Salazar in Manila, says he has noticed an increasing preference among clients for fixed-fee arrangements and success-based billing.

“Hourly billing may not be common or popular in some Asian countries,” says Donovan Cheah, a partner at Donovan & Ho in Kuala Lumpur. “For example, in Malaysia, most clients, especially small and medium-sized business and non-multinational corporations, prefer fixed-fee billing as it allows for predictability and better budget management. Hourly billing is usually adopted by larger firms and is seen as being costlier overall.”

Peter Zhang, general counsel at Sony Mobile in Beijing, says he prefers an hourly rate with a cap per assignment. “With a cap on the total expense, we have better control and avoid big firms, which charge high partner rates but assign juniors to serve.”

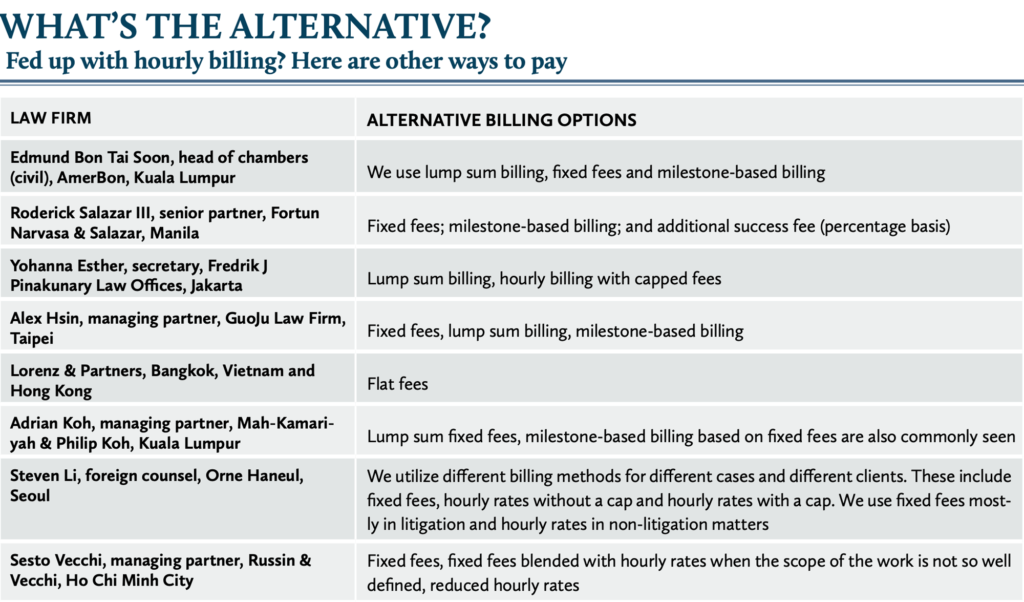

Clients in Singapore, too, have shown a preference for alternative billing, forcing law firms to adapt. “More and more firms are moving away from hourly rate-based fees to lump sum billing, milestone-based and capped fees,” says N. Sreenivasan, the managing director at Straits Law Practice.

In Thailand, says Till Morstadt, the managing partner at Lorenz & Partners, “lump sum billing and fee caps have become more common.”

The in-house counsel with the China state-owned insurer says that most law firms he has worked with are “willing to offer capped fees in line with the current international practice of major financial institutions”. He notes that these firms also have a better understanding of the scope of work that his company provides, and their role as external counsel. “We would be happy if law firms could offer more reasonable and realistic fee quotes and stick to them in future,” he says.

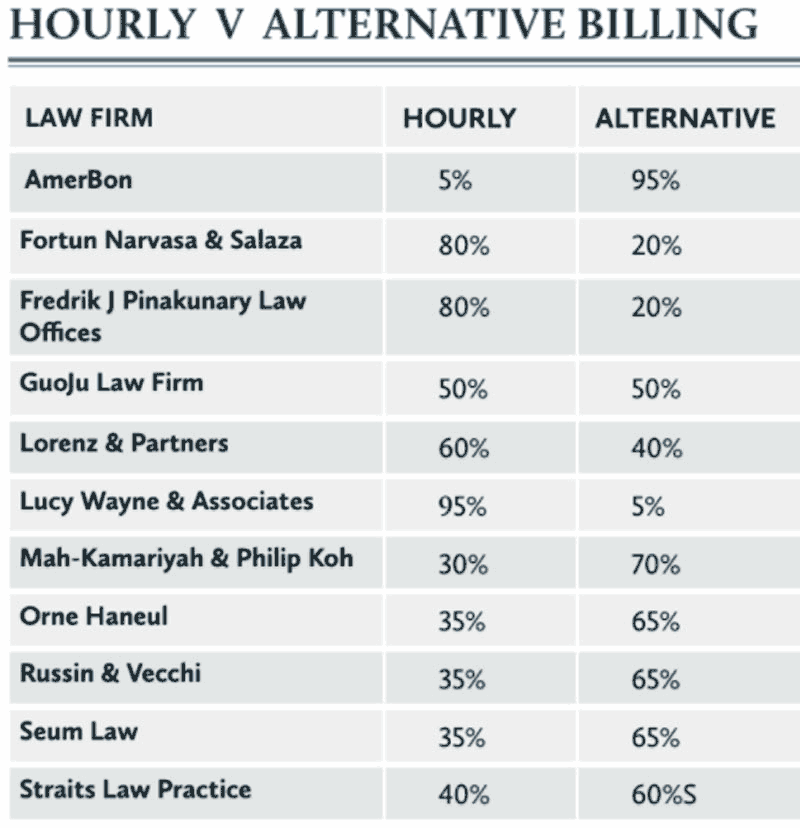

Of course, many law firms still continue to bill by the hour, at least for a portion of their work (see Hourly v. Alternative Billing), and some say the entrance of international law firms has cemented this style of billing. “It seems that ‘fixed charges’ are a Chinese people’s tradition,” says Zheng. “Usually, before we buy something, we like to confirm the price we will finally pay. However, in recent years, with the development of overseas investment and more foreign law firms coming into China, hourly billing has become frequent.”

How low can you go?

Regardless of the billing models employed, it is common for corporate counsel to haggle. But there may be a heavy price to pay for bargaining if they are not astute in selecting the right external adviser. “Law firms are lowballing fees to an unsustainable level in the greed for deals,” says Priya Mehra, the India-based general counsel at InterGlobe Aviation, the parent company of Indigo. “It’s all a vicious circle – large firms, hungry to keep lawyers busy and meet billing targets, result in low fees but do not deliver adequate quality.”

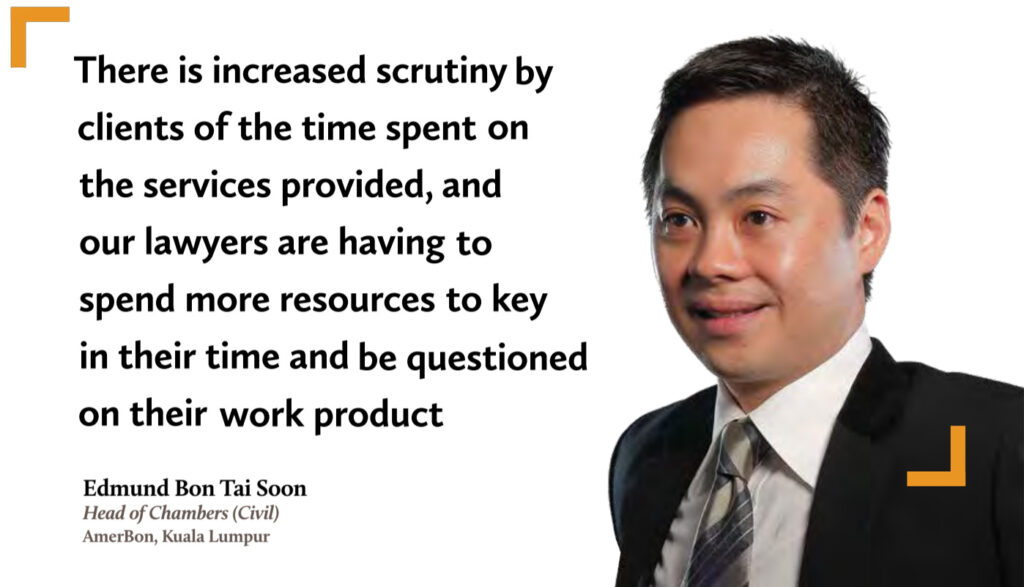

Some law firms will do whatever it takes to jostle for position. Edmund Bon Tai Soon, head of chambers (civil) at AmerBON in Kuala Lumpur, confirms this view: “Larger firms are unreasonably undercutting their fees to remain competitive, only to have junior lawyers handle the matters. It is becoming a race to the bottom.”

Adrian Koh, the managing partner at Mah-Kamariyah & Philip Koh, shares a similar sentiment, describing Malaysia’s legal market as “competitive, challenging and crowded…with limited upside movement in billings”.

This culture of cost competitiveness and undercutting has led to a stagnation of fees in some jurisdictions. Alex Hsin, the managing partner at GuoJu Law Firm, says billing rates in Taiwan “have been frozen for several years, which has made it difficult for law firms to raise their revenue year by year.”

This is also the case for South Korea’s legal market, which has been saturated for years, according to Li at Orne Haneul. “Increasingly more lawyers and law firms emerge year after year. Because of fierce competition, many firms, even big ones, keep decreasing their legal fees to seize cases and clients, which is not good for the healthy development of the legal market and the future of the legal profession.”

In Vietnam, Lucy Wayne, the managing director at Lucy Wayne & Associates, says some firms have started to offer very low fixed-fee packages in order to win work in Myanmar. The refusal by firms to back down from cost-cutting could be driving another challenge that Wayne has noticed — “clients asking for work outside of the scope agreed in fee estimates”.

But some boutique firms have found ways to be nimble while still promising top-quality advice. Seum Law in Seoul offers a number of alternative billing options for non-litigation matters and says other boutique firms tend to do the same.

“One of the options that is popular with our clients is a monthly subscription service under which we provide a set number of hours of work for a fixed monthly fee,” explains partner Steve Ahn. “If we perform work exceeding the agreed number of hours, we charge at a single blended or discounted rate. To provide budget certainty for our clients, we will provide a quote for fixed fees whenever it is possible to define the scope of work. For ICO [initial coin offering] projects, we will, in select cases, agree to work on a success fee basis under which our fees will vary depending on the amount of funds raised through the project. We have found that most of our clients will choose the success fee arrangement when given the option.”

Law firms have devised a number of other novel approaches to billing. For clients pursuing litigation, Straits Law Practice offers a “do-not-exceed guarantee”. As deputy managing director Joseph Liow explains, “fees are charged on an hourly basis… but our firm will absorb the additional time if hourly rates exceed the guarantee”. Corporate counsel involved in contentious cases in Singapore may reconsider their mode of legal combat based on the amount recoverable in different fora.

According to Liow, the costs recoverable by a successful party in court have moved progressively lower. “Costs recoverable in the lower courts (i.e. the Magistrate’s Courts) are fixed and at a low sum, thus making protracted disputes in the lower courts economically unattractive for litigants. Cost recovery in lower courts are in the region of 30-40% of actual legal costs incurred, whereas in the higher courts, this figure moves up to between 50-70%. This [could persuade] litigants into alternative dispute methods such as mediation, neutral evaluation, and arbitration.”

Defining value

Ultimately, to win client loyalty, a law firm must demonstrate value. But as corporate counsel become more discerning and increase their knowledge of legal affairs, lawyers must prove they are worth every dollar spent. There is “increased scrutiny by clients of the time spent on the services provided, and our lawyers are having to spend more resources to key in their time and be questioned on their work product,” says Bon at AmerBON.

But what is good value and what in tangible terms must firms do to win a corporate counsel’s stamp of approval?

“Value for money is when a law firm understands the business and thinks… from the client’s point of view and not from a lawyer’s point of view,” says Gabrielle Tan, company secretary at Wing Tai Holdings in Singapore. Good value, she adds, is when a law firm “provides practical, alternative legal solutions as well as highlighting the pros and cons that come with it”, while also “taking into account the commercial elements in the circumstances”.

Harshitha Thammaiah, general counsel at Xiaomi in Bengaluru, India, says she looks for the “practical and creative application of law” as well as “valuable insights on industry-wide practices” when assessing the value offered by a law firm. “Expertise backed by actual work experience in a particular field and having similar companies as part of their clientele would be plus points to consider paying a law firm a higher fee,” she says.

Mohit Shukla, the managing director and head of legal at Barclays India in Mumbai, shares this view, saying that a law firm’s awareness of a particular business “adds great value and helps distinguish from the value that theoretical knowledge provides”. He adds that clients should pay more if a firm is able to respond to a critical, usually time-crunched issue, promptly and with well-considered views.

In short, corporate counsel expect meticulous advice and will be ready to take their work elsewhere if law firms are not up to scratch. In contrast, firms that can demonstrate superior knowledge of an industry while helping implement a deal may be able to command a higher fee, even on an hourly basis. Mehra expects firms to act as “facilitators and not road-blocks”. She says: “At IndiGo we look for quality and are fine if someone has an hourly billing model which they can justify. I don’t see the value in killing fees and getting average quality advice and attention.”

Source:

https://law.asia/ringing-up-legal-spend-2/

https://www.amerbon.com/wp-content/uploads/20190211-CHATLANI-Ringing-up-legal-spend-Asia-Business-Law-Journal.pdf